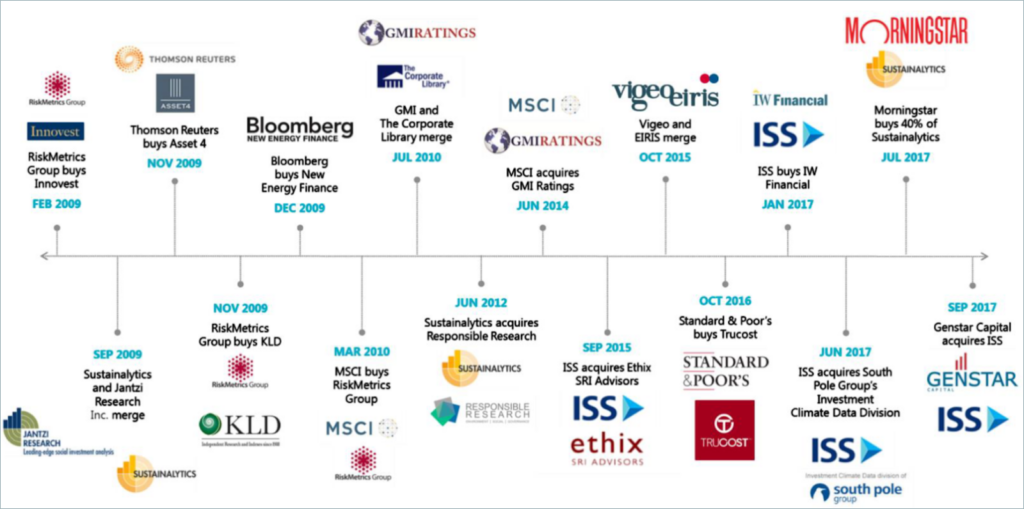

As the assets under ESG management were growing, so was the M&A activity in the ESG ratings provider landscape.

As you can see below, the market is becoming increasingly concentrated.

You can find a nice overview at: https://www.sustainability.com/thinking/rate-the-raters-2020/

When you want to buy the ESG ratings data (something I was involved in with all major ratings providers in 2021), you already often face bundling, and other issues typical for a market where the seller determines the rules of the game.

Competition is good for customers, but it is disappearing from the ESG ratings providers landscape as buyers of these ratings start to go only for the “big names”.

And the “big names” are becoming less and less transparent, more and more costly…

And anyhow it is just an opinion, not a rating so if the “no names” get the ESG quality wrong, it should be no worse than if it is done by the “big names”.

Recent History of ESG Data Vendor Consolidation

Source: Figure from Brown Flynn (2018): The ESG Ecosystem Understanding the Dynamics of the Sustainability Ratings & Rankings Landscape, p. 6.